Hurricane Beryl Smashes Records, Unleashing Insurance Claim Surge

Hurricane Beryl has left an unprecedented mark in its wake, driving State Farm to handle over 16,000 insurance claims—a record for the company. This surge in claims was set off when Beryl struck Texas, marking the first U.S. landfall of the 2024 Atlantic Hurricane season, according to a report by AM Best.

The financial fallout from this historic storm is projected to reach into the billions, reflecting widespread damage to properties and vehicles across multiple states. Initially impacting the U.S. as a Category 1 hurricane, Beryl had already shown its ferocity in the Caribbean as a Category 4 storm. According to Aon, Beryl’s path from Texas to the Northeast caused numerous claims due to powerful winds, heavy rainfall, and subsequent tornadoes.

Widespread Impact: State Farm Reports Claim Surges in Texas, Louisiana, and Michigan; Caribbean Also Severely Affected

State Farm highlighted that most of these claims originated in Texas, with significant numbers also reported in Louisiana and as far north as Michigan. Notably, around 2,000 of these claims were automobile-related, demonstrating the vast reach of Beryl’s impact.

The devastation was not limited to the U.S. The Caribbean experienced severe losses, with insured damages estimated in the hundreds of millions. The Caribbean Catastrophe Risk Insurance Facility (CCRIF) issued record-breaking payouts, including $44 million to Grenada, exceeding its previous largest payout of $40 million to Haiti in 2021. Jamaica received $16.3 million, alongside additional U.S. aid of $2.5 million for storm recovery efforts. Beryl also caused minor damages in Mexico’s Yucatan Peninsula.

In the United States, southeast Texas, including downtown Houston, bore the brunt of Beryl’s aftermath. The storm’s remnants continued to affect a broad area from the south-central U.S. to the Midwest and even parts of Southeast Canada, bringing more rain and wind. Aon noted that Beryl significantly contributed to the highest tornado activity in the U.S. since 2011, spawning at least 28 tornadoes from Texas to the Northeast.

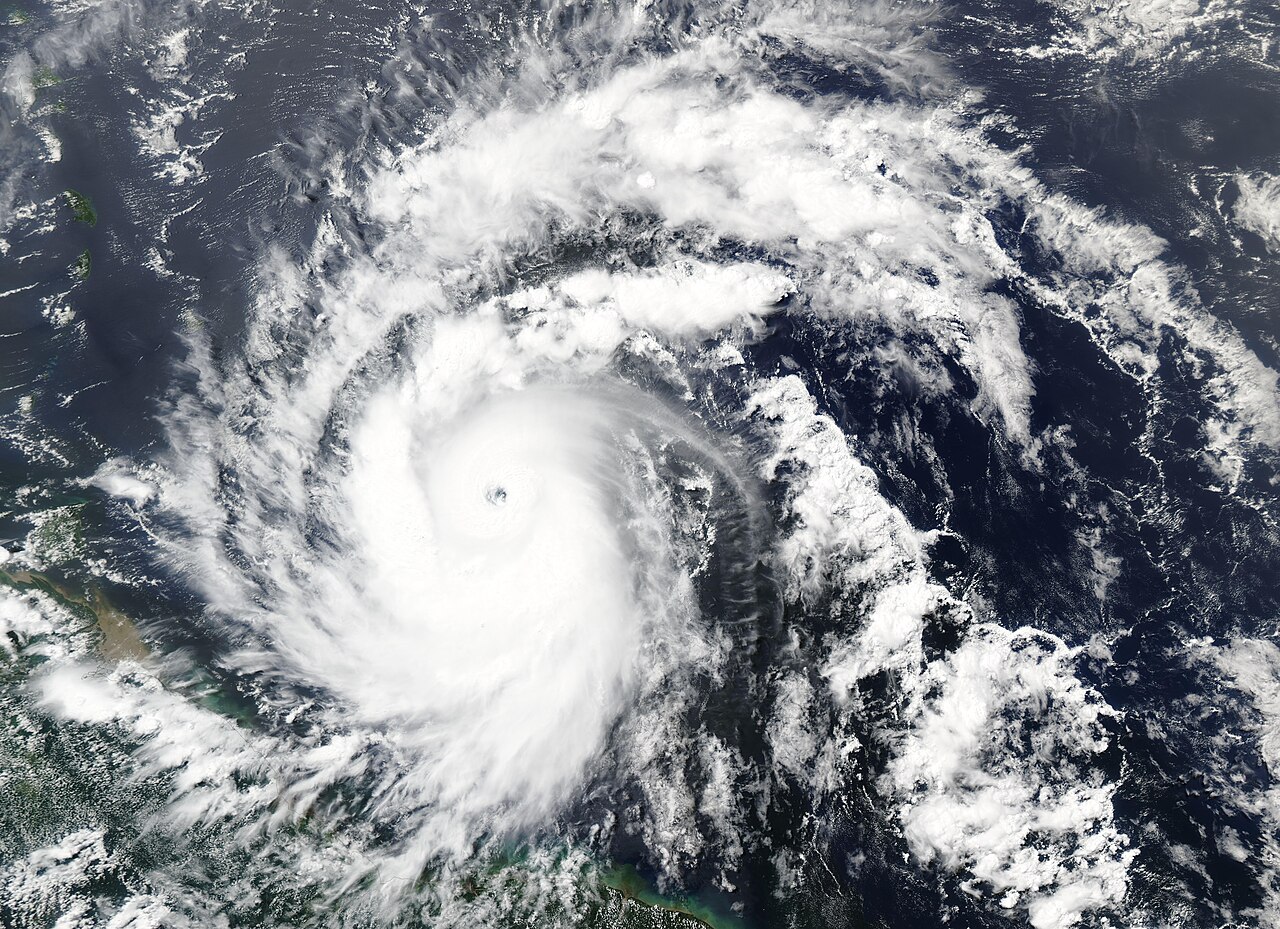

Footage of home damage from the hurricane

Unprecedented Warm Atlantic Temperatures Amplify Beryl’s Impact, Leading to $2.7 Billion in Insurance Payouts

Environmental factors played a crucial role in Beryl’s impact, according to Guy Carpenter. Exceptionally warm Atlantic Ocean temperatures, which have remained at or above record levels since March 2023, facilitated the rapid intensification of hurricanes like Beryl and heightened the risks of larger storm surges.

Analysts predict that private U.S. insurers will face approximately $2.7 billion in payouts related to Hurricane Beryl. Major insurers affected include State Farm, Allstate, and USAA, highlighting the critical role of insurance coverage in mitigating disaster-related losses.

In Other News: State Farm Seeks Major Rate Increases in California

As State Farm manages the massive fallout from Hurricane Beryl, it is also moving to implement significant rate hikes for residential insurance policies in California, potentially affecting millions of homeowners and renters. The insurer has filed for a 30% increase in homeowners’ insurance rates, a 52% hike for renters, and a 36% rise for condominium owners. This represents the third major adjustment by State Farm in California within a year.

State Farm stated that these rate increases are essential for the long-term sustainability of its California subsidiary, State Farm General. The company cited rising costs and the necessity of maintaining financial health as primary reasons for the proposed rate hikes. If approved, these changes will substantially impact insurance expenses for residents across the state.

State Farm’s dual challenges of addressing the surge in claims from Hurricane Beryl and justifying substantial rate hikes in California highlight the complex and often volatile nature of the insurance industry amid increasingly severe weather events and shifting economic conditions.